FinBot: Unified Banking Chatbot

ROLE

UX Researcher / Designer

Dates

Fall 2024

Duration

10 Weeks

F

FinBot

FinBot is an intuitive, user-friendly chatbot that enables users to manage all their bank accounts across multiple banks in one place. The goal was to simplify banking tasks and resolve account issues through a seamless chat interface.

Actual Design

Problem Statement

Managing finances across multiple banking apps is time-consuming, confusing, and lacks consistency.

Users struggle with fragmented experiences, slow customer support, missed payment deadlines, and delayed alerts for pending documentation or verification.

There’s a clear need for a secure, unified, and conversational solution that simplifies everyday banking tasks all from one place.

Goals

Centralize multiple bank accounts in one secure place

Simplify everyday banking through a conversational interface

Build trust through transparency and strong security

Reduce dependency on visiting multiple apps

Design Process

Research

UX Design

User Flow

Wireframe

Final App Design

1

2

3

4

5

Banking Customers

50+

Research

To ground the design in real user needs, I conducted a survey with 50+ banking customers across various demographics.

Goal

Understand how people manage multiple bank accounts and what they expect from a centralized chatbot experience.

Respondents reported frustration with managing multiple banking apps and desired a unified solution.

73%

68%

Users preferred a ChatBot over traditional customer service calls for quick banking queries.

User Flow

To design an optimal experience, I mapped out possible user journeys in Figma, analyzing each step to ensure a smooth and intuitive flow.

Sign In /

Sign Up

ChatBot

Home

Chatbot

Reply

User

Query

Profile

Accounts

User Persona

At the initial stage, we focused on creating detailed user personas using Human-Centered Design methods. This ensured the application was tailored to real user needs and behaviors.

Too many options clutter the interface

Simple tasks take too long to complete

Calling customer service feels like a waste of time

Frustrations

Check bank account easily

Use banking services without complex navigation

Manage payments and transfers seamlessly

Goals

Name: Alex Cooper

Age: 27 Years

Profession: Small Business Owner

Alex runs his business full-time and needs quick, reliable access to banking tools to manage payments and monitor transactions on the go.

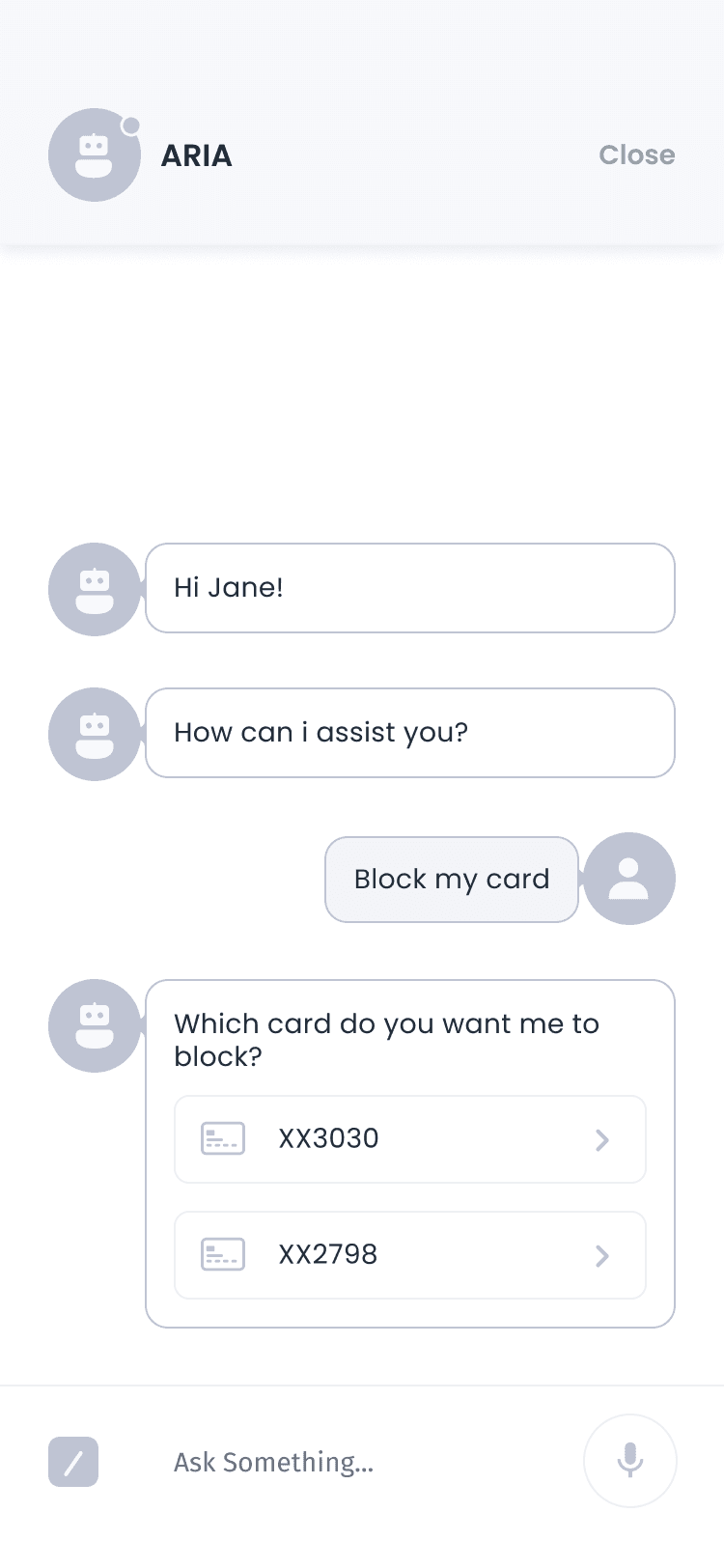

Name: Jane Foster

Age: 31 Years

Profession: HR Manager

Jane has a busy work schedule and prefers quick access to updates about EMIs, salary deposits, and card status during short breaks.

Track account balance instantly

Stay informed about EMI payment schedules

Block or unblock credit cards on the go

Goals

Overwhelmed by too many options

Struggles to find specific functions like EMI details

Takes too many clicks to complete basic tasks

Frustrations

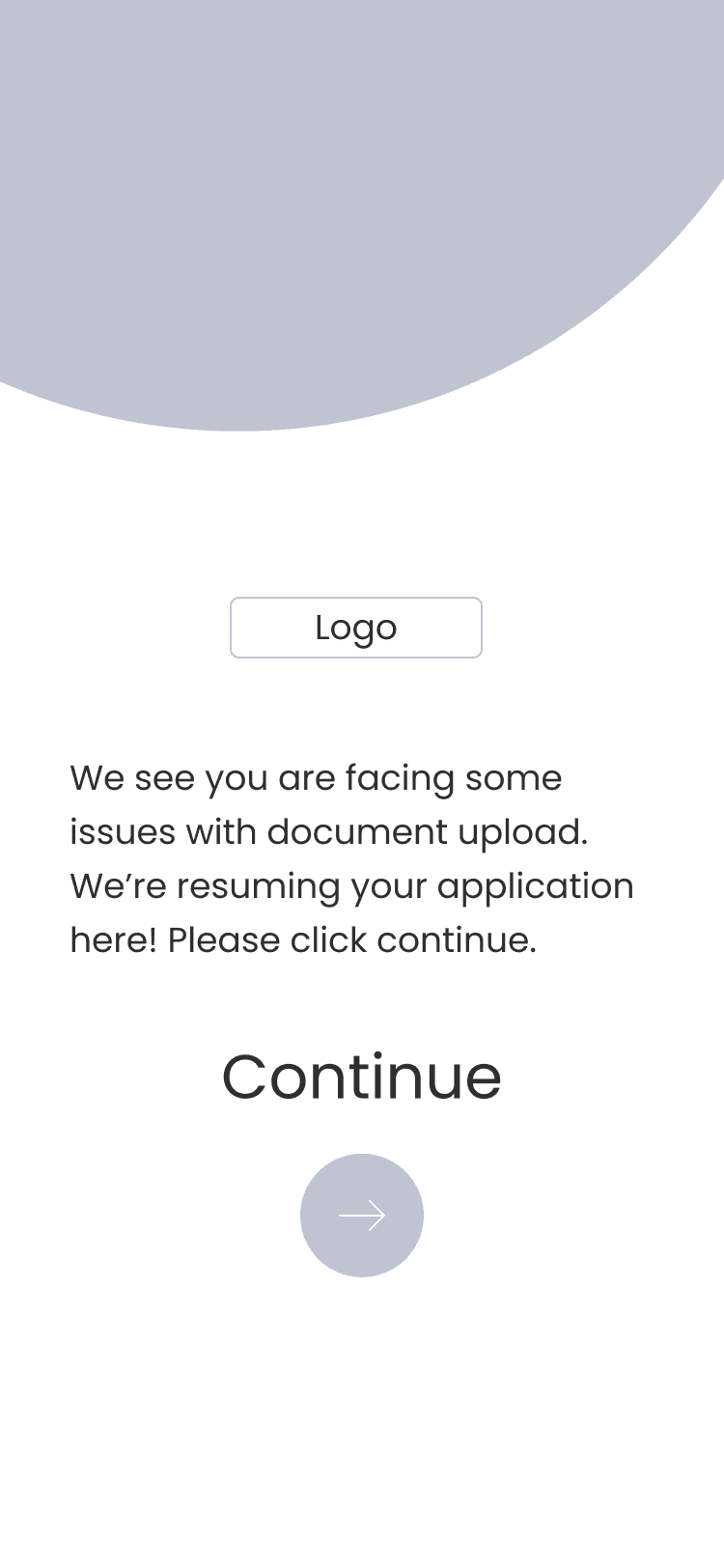

Wireframes

Based on the research conducted at the UX stage, we started developing wireframes. It was important to conveniently arrange the elements on the screens and provide an intuitive structure of the application.

FinBot

FinBot

FinBot

FinBot

Style Guide

We wanted to choose a bright and eye-pleasing color palette and readable front, as the application will be used on all phone sizes.

Primary & accent colors

Secondary colors

3894FF

323232

#5F80F8

#EBF5FF

#192A3E

#27AE60

Typeface

Poppins

ABCD

abcd

1234

Screen Preview

Below we will take a look at the most important application screens separately.

Bank Accounts & Cards

User can add bank accounts and cards, enable/disable reminders, and check transactions.

EMI Status

User wants to know are there any pending EMI’s for this month, Chatbot will take that query and reply with the EMI status.

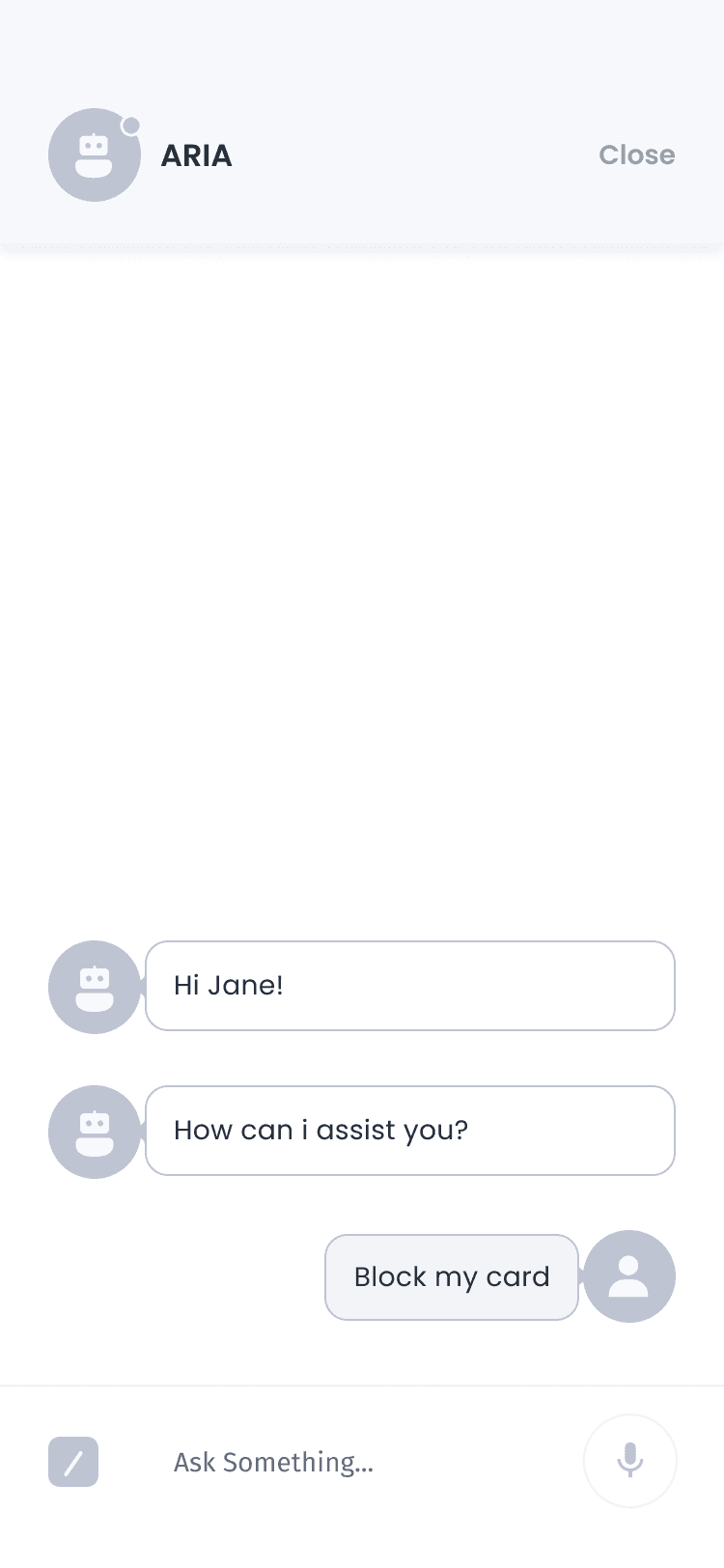

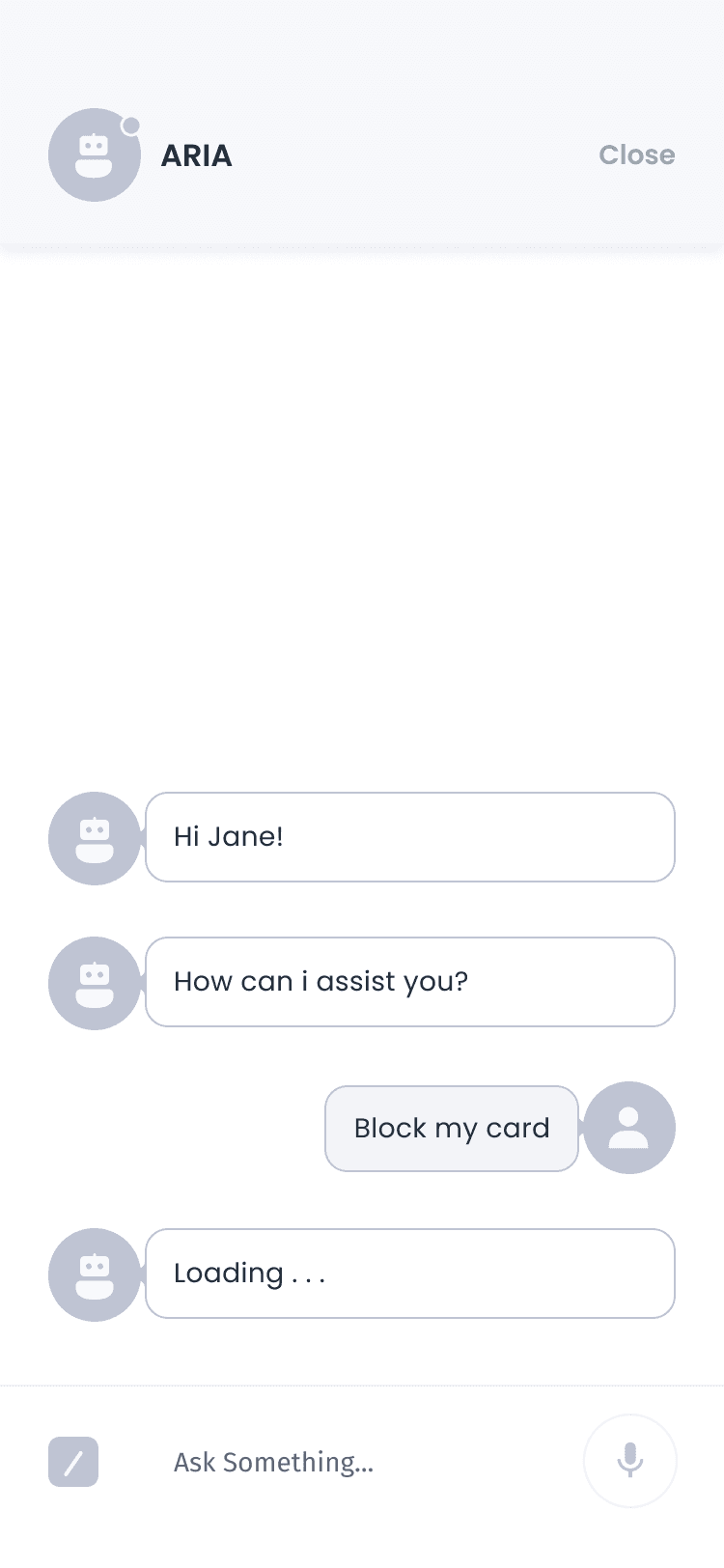

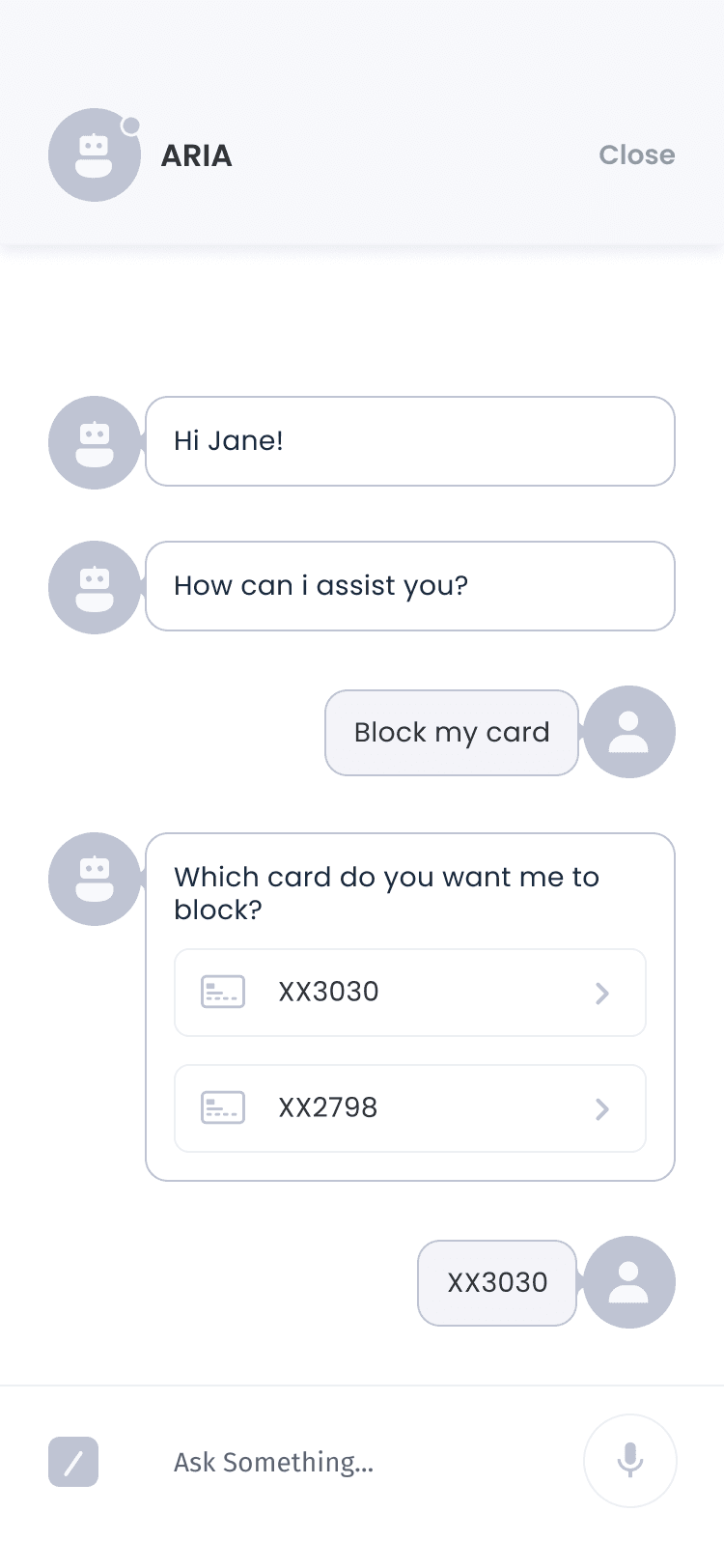

Block Card

FinBot chatbot can block or unblock user’s credit card with just one message.

Usability Testing

50+ Participants

92%

Task completion rate

successfully completed basic tasks (checking balance, recent transactions, fund transfers)

2.8 seconds

Average response time

significantly reducing wait times compared to traditional banking support.

87%

Error resolution efficiency

of reported issues were resolved in a single chatbot interaction.